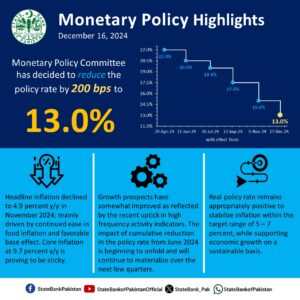

Monetary Policy Statement – December 16, 2024

Policy Rate Mein 200 BPS Cut, Ab 13% Per Aagay

Monetary Policy Committee (MPC) ne aaj ka meeting ke baad policy rate mein 200 basis points ki kami kar ke usay 13% par la diya, jo 17 December 2024 se effective hoga. Headline inflation November 2024 mein 4.9% par aa gaya, jo MPC ke expectations ke mutabiq hai. Food inflation ka girna aur November 2023 ke gas tariff hike ka effect phase out hona is decline ki wajah hai. Lekin core inflation 9.7% par sticky hai, aur consumers aur businesses ke inflation expectations abhi bhi volatile hain. MPC ka kehna hai ke inflation near-term mein thoda volatile reh sakta hai, magar target range mein stabilize ho jayega. Growth ke prospects better ho rahe hain, aur economic activity ke high-frequency indicators se bhi ye signal mil raha hai.

Key Developments jo Economic Outlook ko Affect Kar Sakte hain:

- Current account surplus teesri baar lagatar October 2024 mein bhi raha, jo $12 billion ka FX reserves banane mein madadgar tha.

- Global commodity prices favorable rahi, jis se inflation aur import bill par positive asar hua.

- Private sector ko diya gaya credit noticeable increase dikhata hai, banks ke ADR thresholds meet karne ki koshish ki wajah se.

- Tax revenues ka shortfall target se zyada ho gaya hai.

Growth Prospects Aur Real Sector:

Economic growth ke prospects improve ho rahe hain. Agriculture sector mein cotton ki better arrivals aur wheat ke sowing area ke encouraging data se outlook stable lag raha hai. Industrial sector mein bhi momentum hai, jaise ke textile, food, automobiles aur POL ki strong growth Q1-FY25 tak nazar ayi. Cement, auto, fertilizer aur POL products ki sales ke high-frequency indicators bhi momentum ko show karte hain. MPC ne forecast kiya hai ke GDP growth FY25 mein 2.5-3.5% range ke upper half mein rahegi.

External Sector Mein Improvement:

July-October FY25 ke current account mein $0.2 billion ka surplus record hua. Exports 8.7% grow hui hain, especially HVA textile, rice aur POL exports ki wajah se. Import bill stable raha despite zyada volume ke imports. Workers’ remittances strong rahi hain, aur FX reserves ke June 2025 tak $13 billion exceed karne ki umeed hai.

Fiscal Sector Challenges:

Tax revenues mein 23% y/y growth ke bawajood annual target achieve karna mushkil hai. Interest payments ka girna fiscal deficit ko kam karne mein madad karega, magar primary surplus achieve karne ke liye additional measures ki zarurat hogi.

Inflation Aur Money Supply:

November 2024 mein headline inflation 4.9% tak gir gaya, mainly gas prices ke base effect aur food inflation ke moderation ki wajah se. MPC ne FY25 ke inflation forecast ko revise karte hue kaha ke average inflation ab pehle ke 11.5-13.5% range se kaafi neeche rahegi. Lekin resurgence in food inflation aur revenue shortfall ke measures se risks remain karte hain.

Ye measured policy stance inflation ko stabilize karne ke liye appropriate hai, aur sustainable economic growth ko support karta hai.