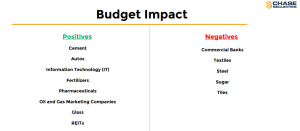

ISLAMABAD: Finance Minister Ishaq Dar ne 09 June 2023 ko Federal Budget pesh kia or uske Pakistan Stock Market pe kia impacts hongay.

Pakistan Stock Exchange

Bonus Shares pe 10% TAX

Companies k extraordinary gains per 50% tax imposed (booked b/w 2019-2023)

Re-imposition of Super TAX:1%-10%

Commercial Banks

Banks per 10% Super TAX continue, or TAX rate 39% – 49% tak increased

Non-filers k accounts per withholding TAX re-imposed on withdrawals (at the same day) above PKR 50,000

Low-cost housing, agriculture SMEs including IT & IT enabled services kay incremental loans per next two years kay lea 20% TAX reduced

Exogenous Factors ki wajeh se extraordinary gains on profit and gains of accounts per 50% tax ka izafa.

Autos

Hybrid Electric Vehicles ki import per CD 1% reduced

Used and old Vehicles of asian make above 1300cc ki import per removal of cap on fixed duties and taxes

NON localized (CKD) of Heavy Commercial Vehicles per 10% se 5% Custom duty reduced

Information Technology

IT & ITeS exports kay lea Concessionary fixed tax rate of 0.25% next 3 years k lea continue

IT-related equipment ki duty-free imports ki 1% value is equivalent to their exports proceeds.

Pakistan Software export Board kay sath registered IT & ITeS ki imports per sales Tax exemption

Startups kay lea Venture Capital Fund me PKR 5 bn ki amount allocate kardi gae

IT & ITeS sector me additional advances se banking Company ki income per 20% Concessionary TAX kay Standard rate 39% hongay

IT & ITeS ki Exports k lea 0.25% ki concessionary fixed TAX avail karne k sales TAX return file withdraw

Fertilizers

Imported Urea kay lea PKR 6 bn subsidy allocated

Agri-loans PKR1,800 bn se increase kar ke PKR 2,200 bn kardiye gae

Imported seeds per all duties and tax khatam karne ka faisla

50,000 Tube wells ko solar energy me convert karne k lea PKR 30 bn allocated

Construction

PSDP ki allocation last year k muqable me 32% increased hokar Rs. 950 bn kardi gae

Constructing house k lea 10% or Rs. 0.5 mn TAX credit provided

FATA/PATA kay sales TAX exemptions ek sal k lea extended

Foreign Remittance kay through property purchase per 2% ka adv final tax khatam kar diya gaya

Banks kay lea additional advance for construction mein 20% tax rate reduced

Textiles

Minimum wages mein Rs. 32,000/month increase

Calcium Carbide per custom duty 3% se 10% tak increased

Textile & leather products ki retail POS sales per sales tax ki reduced rate me 12% se 15% increase

Extraordinary gains such as inventory gains per 50% TAX increased

Oil and Gas Marketing Companies

OMCs ka turnover TAX remains fixed on 0.5%

Petroleum Development Levy (PDL) remains unchanged at Rs50/liter.