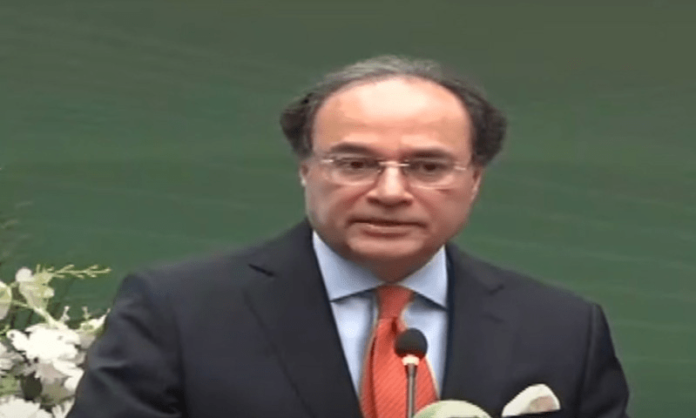

ISLAMABAD, Dec 4: Federal Minister for Finance aur Revenue, Muhammad Aurangzeb ne kaha ke housing sector ke liye directed lending system pe wapis nahi jayenge, balke bank-led financing ko incentivize karne par focus hoga. Unho ne ye baat International Affordable, Green & Resilient Housing Conference mein ki.

Aurangzeb ne kaha, “Directed lending ghalat system tha, jo distortions create karta hai aur medium-term implications hoti hain.” Hukumat housing finance promote karne ke liye incentivization mechanisms create karegi, jo banks aur microfinance institutions ko housing loans provide karne ke liye encourage karega.

Unho ne further kaha ke housing sector ka taluq do bade challenges se hai: population growth aur climate change. Pakistan ki population 2.5% ki alarming rate se barh rahi hai, jo child stunting, poverty aur education ke issues create kar rahi hai, khas kar girls ki schooling mein kami. Affordable aur resilient housing in problems ko address karne mein madadgar ho sakti hai.

2022 ke floods ke baad resilient housing ki zarurat samajh aayi, aur Sindh Government ne water banks par ghar banane discourage karna shuru kar diya hai. Hukumat housing finance ke liye ek regulatory authority banane ka plan kar rahi hai aur foreclosure laws introduce karegi taake banks ko housing loans dene mein confidence mile.

Economy ke hawale se unho ne kaha ke Pakistan ne sustainable aur inclusive growth ke liye achi progress ki hai. Pichle 14 mahino mein fiscal aur current account deficits mein kami hui hai. Foreign exchange reserves ab 2.5 mahine ki imports cover karte hain, jo pehle sirf 2 hafton ka tha. Fiscal year ke end tak reserves 3 mahine ki imports cover karne ke maqam tak ponchne ki umeed hai.

Inflation bhi control mein aayi hai, jo November mein 78 mahino ke lowest level 4.9% par thi. Policy rate aur benchmark KIBOR dono mein further kami ki umeed hai.