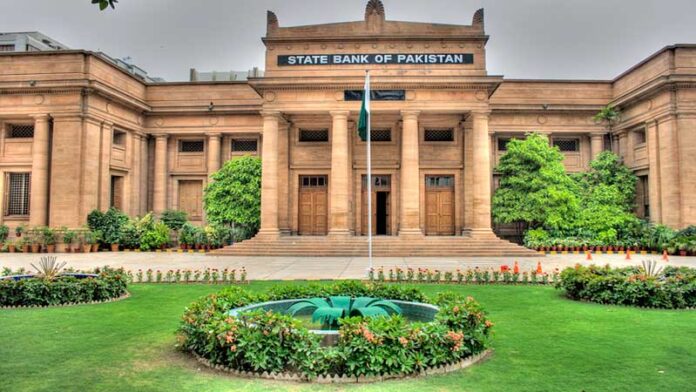

Karachi: State Bank of Pakistan (SBP) ne World Bank Group ke private sector arm, International Finance Corporation (IFC), ke sath partnership ki hai taa’ke Pakistan mein local currency financing ko expand kiya ja sake aur private sector ki growth ko support diya ja sake.

SBP ke mutabiq, ISDA agreement ke zariye ye partnership IFC ko currency risks ko behtar manage karne aur Pakistani rupees mein investments barhane ke qabil banayegi. Ye qadam mulk ke critical sectors ke liye financing unlock karne aur mulk bhar mein rozgar ke mauqe paida karne mein aham hai.

SBP ke Governor Jameel Ahmad ne kaha, “Pakistan mein private sector ki growth ko promote karna mulk ki sustainable economic development ke liye bunyadi zarorat hai.”

IFC ke Vice President aur Treasurer John Gandolfo ne kaha, “Currency volatility developing economies ke liye significant risk hai. Local currency financing tak access ab pehle se zyada zaruri hai. Is type ki financing ko promote karna World Bank Group ki strategic priority hai aur Pakistan ke economic growth ke liye catalyst ka kaam karega.”

Developing economies mein companies jo hard currencies (jaise US dollar) mein borrow karti hain lekin revenue local currency mein earn karti hain, unke liye exchange rate risks ek bara challenge hai. Is currency mismatch ko address karna local businesses ko risk mitigate karne, financial resilience maintain karne aur overall economic stability ko support karne ke liye zaruri hai.

IFC innovative financial instruments aur partnerships ke zariye emerging markets mein local currency financing ke growing need ko address karne ke liye committed hai. Is partnership ke zariye SBP ka maqsad economic resilience ko barhawa dena, private sector development ko promote karna aur Pakistan mein foreign exchange liquidity ko improve karna hai.

IFC, jo World Bank Group ka member hai, emerging markets mein private sector par focused sab se bara global development institution hai. IFC 100 se zyada countries mein kaam karta hai aur fiscal year 2025 mein developing countries ke private companies aur financial institutions ko record USD 71.7 billion commit kiye, jis se private capital mobilize karke poverty-free aur sustainable world create karne mein madad milti hai.